What is a Chargeback Ratio?

Your chargeback ratio is all-important when dealing with your payment service provider and the credit card networks. To stay in their good graces, you will need to monitor your chargeback ratio to make sure it never rises above certain thresholds. Which begs the questions: How is your chargeback ratio calculated? The answer depends on the credit card network.

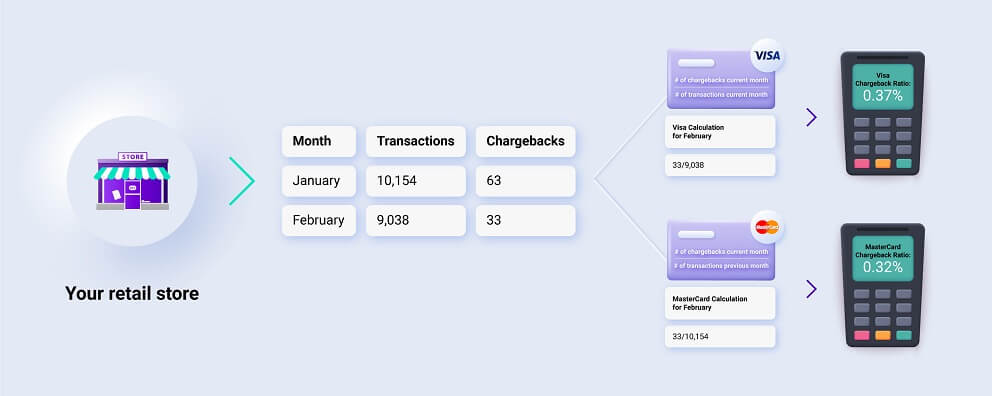

On a basic level, the chargeback ratio (sometimes referred to as the chargeback-to-transaction ratio or CTR) is a measure of the total chargebacks received divided by the number of sales transactions you have within a month.

ROW LAYOUT: banner_component

If you have a chargeback ratio above 0.9 percent, contact Justt

Different brands, different calculations

Visa, American Express and Discover determine the chargeback ratio based on the number of chargebacks received in the current month divided by the number of sales processed within the current month. On the other hand, MasterCard derives the chargeback ratio on its card network based on the number of chargebacks received in the current month divided by the number of sales processed in the previous month. To see a clear example look at the infographic below. You can also read the subsequent tables to see how to calculate monthly chargeback ratios over an entire quarter.

ROW LAYOUT: table_component

ROW LAYOUT: table_component

Programs for monitoring chargebacks

For merchants that accept multiple card brands, each card network’s chargeback ratio is counted separately. That means, for example, that MasterCard credit card transactions aren’t included in the calculation of the chargeback ratio for Visa. American Express chargebacks aren’t counted in the chargeback ratio for Mastercard, and so on.

The card networks require acquirers to calculate and monitor their merchants’ chargeback ratios monthly. If a merchant exceeds certain chargeback thresholds, they can be placed in a monitoring program and even face steeper chargeback fees. Click here for more information on monitoring program chargeback fees.

For Visa, a merchant is placed in the regular chargeback monitoring program if they exceed a chargeback ratio of 0.9 percent and have 100 or more chargebacks per month. The excessive chargeback monitoring program begins at a 1.8 percent chargeback ratio and 1,000 chargebacks or more per month.

For MasterCard, a merchant is placed in the excessive chargeback monitoring program if they exceed a chargeback ratio of 1.5 percent and have 100 or more chargebacks per month. The high excessive chargeback monitoring program begins at a 3 percent chargeback ratio and 300 chargebacks per month. Go to this video on YouTube for a more detailed explanation of the high excessive chargeback monitoring program.

Does Win Rate Impact Chargeback Ratio?

No, successful chargeback reversals do not remove the chargeback transactions from the chargeback ratio calculation. This is important to know, as you could have a high win rate for chargebacks but still end up in a chargeback monitoring program. The point for the credit card networks is that you should be focused on preventing chargebacks from happening in the first place. Having said that, payment service providers (PSPs) will often cut you some slack and work with you on fixing your chargeback problem instead of dropping you if they see that you are winning most of your chargeback cases.

Creating your own metric

It’s worth pointing out that the chargeback ratio used by the credit card networks and your acquirer just measures the number of chargebacks as a percentage of transactions, not their dollar value. You may create your own ratio of total chargeback amount to total sales to see how chargebacks are impacting your profitability. For the purposes of comparison, don’t just view that ratio in the context of total revenue but compare it to your profit margin as well. Sometimes merchants leave a significant amount of money on the table just because they view chargebacks a manageable business expense relative to revenue, when they are in fact losing a significant amount from their bottom line to illegitimate chargebacks.

For more advice on how your chargeback ratio reflects and impacts your business, reach out to us at Justt.

Take the next step and contact us